Maximum Compensation for Your Property Loss

We’ll Represent You in Your Fight Against Property Insurance Claim Denials, Delays, and Bad Faith Practices

Schedule your free consultation with our property insurance attorneys today.

We will meticulously review your insurance policy and claim details, assessing your coverage limits and the extent of your loss, before discussing your potential courses of action.

Our commitment is solely to policyholders, encompassing homeowners, homeowners’ associations, and commercial property owners such as hotels, churches, restaurants, car dealerships, medical facilities, and others facing insurance claim disputes after catastrophic property losses. We do not represent insurance companies.

No Upfront Costs

Reliable Communication

Compassionate Legal Counsel

Increased Insurance Settlements

Why Partner with Howard Stallings Law Firm Property Insurance Lawyers?

We are Experienced in Property Insurance Law.

Since our inception in 1983, our law firm has been representing the interests of businesses and individuals across North Carolina. With offices in New Bern, Morehead City, and Raleigh, our property damage attorneys are ideally positioned to assist clients statewide.

As a respected North Carolina law firm, our property insurance attorneys are highly knowledgeable about the state’s insurance laws, regulations, and court precedents. We excel at challenging insurance companies over bad faith practices, using our extensive local experience and knowledge to argue effectively for your case.

With our primary focus on North Carolina, we are intimately familiar with both the legal and physical landscape of our state, offering guidance as you seek rightful compensation through the legal system. Understanding the stress and hardship you’ve faced; we ensure prompt responses to all inquiries within 24 hours (usually sooner). Our dedication to assisting fellow North Carolinians in the aftermath of catastrophes is unwavering, and we have the track record to prove it.

Our Process: Maximizing Your Property Damage Settlement

-

Meeting with you, free of charge.

Meeting with you, free of charge.

-

Enlisting professionals to evaluate and document your property damage.

Enlisting professionals to evaluate and document your property damage.

-

Skillful negotiation with your insurance company.

Skillful negotiation with your insurance company.

-

Filing lawsuits and offering robust legal representation in coverage litigation.

Filing lawsuits and offering robust legal representation in coverage litigation.

-

Pursuing claims against your insurance company for unfair practices and bad faith when warranted.

Pursuing claims against your insurance company for unfair practices and bad faith when warranted.

-

Assisting in the appraisal process, including umpire appointment hearings as needed.

Assisting in the appraisal process, including umpire appointment hearings as needed.

Testimonials

Results* from Recent Cases

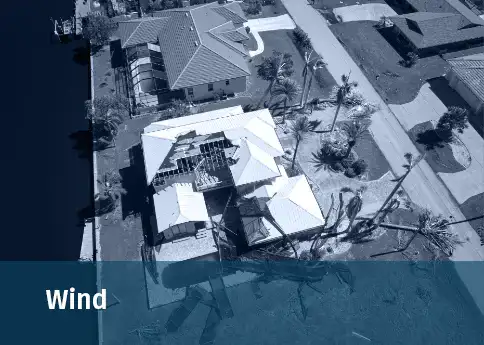

$1 million

Wind Loss property insurance dispute

$1.5 million

Water Loss

$5 million

Hurricane Damage claims

$5.1 million

Bad Faith Settlement

*past results do not guarantee future performance

Schedule A Free Consultation

"*" indicates required fields

Our Law Firm Blog

Emotional Distress Damages in Property Insurance Claims: Are They Recoverable?

When navigating the aftermath of property damage, homeowners often not only face the physical loss of their property but also significant emotional distress. This stress can be exacerbated by the way an insurance claim is handled. In North Carolina, the question of...

An Insurance Company’s Burden of Proof in Alleged Arson Claims

Under North Carolina law, when an insurance company contends that a fire loss is not covered due to the insured's intentional actions, such as setting the fire deliberately, specific legal standards and principles apply. This blog aims to unpack these standards and...

What is Surplus Lines Insurance?

Surplus lines insurance is a specialized type of coverage for risks deemed too complex or unconventional for standard insurance markets. When traditional insurance carriers are too expensive or decline to provide coverage due to the nature of the risk or other...